Beauty & Hair Salon Industry Statistics

Welcome to our comprehensive salon industry statistics 2022 – 2025. We have gathered salon industry statistics from the global salon services market in the US and Canada to provide the facts you need for your salon business.

Benefit from our extensive research on the beauty salon industry. Choose which of the latest trends reports interest you the most to get factual beauty salon industry statistics.

Beauty Business Acquisition Statistics

Professional Brand Preferences (2023)

Workplace & Hiring Statistics:

Below, you can find general salon industry facts gathered since 2022.

How big is the hair salon industry in the US?

The hair salon industry in the US includes approximately 444,102 licensed salons, spas and barber shops in 2023. Our reports reflect approximate numbers for states that were unreachable for this information.

We gathered data from each state for this report, the census and the Professional Beauty Association, (PBA), had incorrect reporting per state.

States who were uncooperative or had inaccessible information are:

Alabama

Alaska

Connecticut

District of Columbia

Illinois

Louisiana

Mississippi

New Hampshire

New York

Oklahoma

Utah

Market size notes on Utah hair stylists and salons: Utah does not license establishments, reports on Utah are estimated.

Establishment Report: Beauty Salons, Spas and Barber Shop Market Size 2023

Every cosmetology, esthetics, massage and barber state board has different requirements for licensure. Some state boards combine license and establishment types, others separate by salon services or license type.

This was a gargantuan task to complete, going state by state and asking them directly for information. There are pockets of caucasian, african american, hispanic and other hair stylist businesses operating without licenses, these entities are not included in our statistical reports.

Below is the information on each state provided by the licensing boards.

Number of salons, spas and barber shops by state

Alabama- 6,250 *estimated

Alaska- 916 *estimated

Arizona- 8,875

Arkansas- 3,900

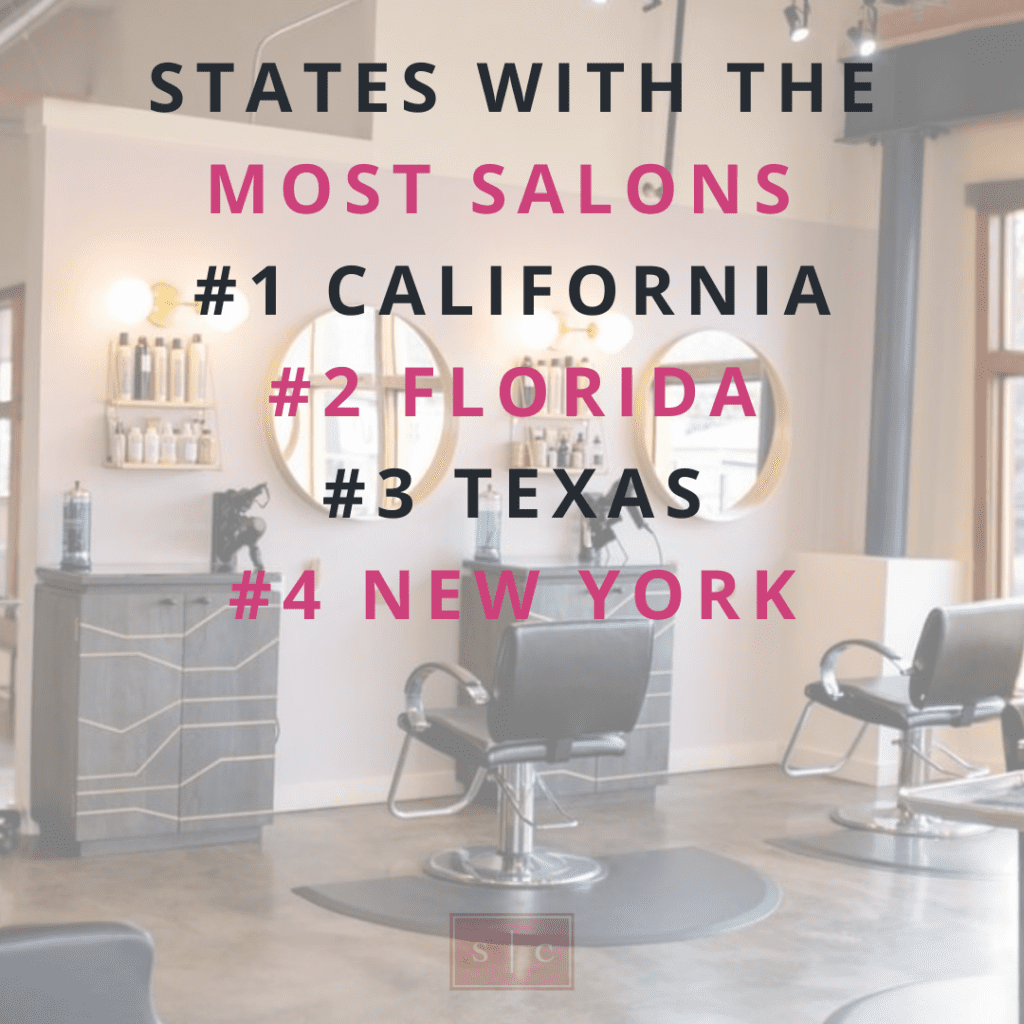

California- 53,747

Colorado- 6,661

Connecticut- 4,500 *estimated

District of Columbia- 861 *estimated

Delaware- 665

Florida- 40,060

Georgia- 13,656

Hawaii- 2,389

Idaho- 2,687

Illinois- 16,240 *estimated

Indiana- 8,455

Iowa- 4,571

Kansas- 4,887

Kentucky- 5,500

Louisiana- 5,750 *estimated

Maine- 1,919

Maryland- 5,521

Massachusetts- 10,415

Michigan- 11,492

Minnesota- 6,007

Mississippi- 3,625 *estimated

Missouri- 13,803

Montana- 1,680

Nebraska- 3,152

Nevada- 3,422

New Hampshire- 1,625 *estimated

New Jersey- 17,727

New Mexico- 1,872

New York- 25,250 *estimated

North Carolina- 16,200

North Dakota-2,106

Ohio- 15,647

Oklahoma- 4,875 *estimated

Oregon- 4,707

Pennsylvania- 20,322

Rhode Island-1,320

South Carolina- 8,261

South Dakota- 2,620

Tennessee- 10,887

Texas- 32,578

Utah- 4,010 *estimated

Vermont- 785

Virginia-7,630

Washington- 8,590

West Virginia- 2,585

Wisconsin- 8637

Wyoming- 772

Hair Salon Industry Statistics Overview

An interesting discovery happened when researching facts about hairdressers, hairstylists, and cosmetologists. There was no concrete data on the hair industry statistics, nail salons, spas, or barber shops.

No one seemed to be able to nail down how many hair salons there are or what is really going on with salon employment. Even consumer preferences and consumer behavior are virtually impossible to determine.

Our labor statistics reports are the most comprehensive guides for salon owners to understand workplace preferences in hiring.

Where did our salon industry statistics for employment originate?

Employment, booth rental, salon suite rental, and hybrid salon information were gathered from the Enlightened Hire program. Enlightened Hire was an experimental project designed to determine the wants, needs, and preferences of the salon, spa, and barber industry when it comes to making workplace decisions.

Enlightened Hire was offered in the US and Canada only; statistics reflect preferences from these two countries only.

This includes a wide range of salons, spas, and barbershops and a diverse group of hair stylists, barbers, nail technicians, estheticians and massage therapists.

Hair Stylist Employment Statistics

Do students want an hourly wage? What are local salons offering for female hairstylists and cosmetologists?

Thousands of salon, spa, and barber professionals have voiced their opinions! Uncover the secrets to hair stylist employment wants, needs, and preferences in our comprehensive hair stylist report.

What is the average age to enter the beauty industry?

The average age to enter the beauty industry is 20 years old. You must have a high school diploma or GED to attend cosmetology school

Is there a gender pay gap in the beauty services industry?

Our reports reveal that male and female hairstylists have an equal opportunity in beauty salons for both wage annual reports and in prices for booth rental salons. Beauty salons do not differ in annual wage for African American beauty professionals, male hair stylists, or female hair stylists.

Beauty Salons RESTRAINING FACTORS

When it comes to hiring, beauty salons have a lot of competition without proper recruitment training. Many salon owners work behind the chair and are dependent upon their income to keep the salon afloat.

This leaves owners with little time to invest in hiring salon and spa professionals. Hiring and finding booth rental hair stylists is the #1 biggest salon industry revenue problem in 2023.

Hair stylist retention rates & salon labor statistics

The second biggest issue facing salon industry owners is staff retention. The US economy has had a profound impact on low annual wage salons and expensive salon suites.

Salons that do not offer benefits like client building or business support are finding new ways to help salon pros grow and create disposable income. If you are struggling to retain salon staff, consider hiring a salon mentor or coach to help you reach your hair industry goals.

Hair salon industry statistics 2023: wages

Hair stylists earn, on average $12,000 per year, part-time. With the threat of losing federal funding for cosmetology schools and unreported wages, there is much room for improvement in the Salon Industry Statistics 2023 report.

Work Environment in the Hair Salon Industry

Salon industry statistics show that the popularity of booth rental and salon suites continues to rise. In 2023, there have been a higher than usual employment requests from booth rental salon professionals, wanting to get back into commission and hourly salon environments.

The salon data reports: Most hair stylists and salon industry professionals desire the freedom and flexibility of suite and booth rental. The problem lies within the individual’s ability to be a business owner.

We predict growth for hourly wage salons, spas, and barbershops to be on the rise in 2024-2026, amidst the unstable economy and burnout of independent salon professionals who go into booth rental too early in their careers.

The company size where hair stylists work

Does size matter in salon hiring? According to our statistics, it does.

Salon, spa, and barber pros have spoken about their preferences for not only corporate-owned salons, but also what size of salon they prefer to work in.

Get the full report of workplace preferences of hair stylists, students, and experienced salon & spa professionals in our statistical reports.

What is the success rate of new Hair Salons?

New hair salons and skin care businesses have an average success rate of 50% in the first 3 years of business. Determining factors in success include: salon industry experience and knowledge, marketing initiatives, pre-existing client base, market research, and business acumen.

If you are considering opening a salon, learn more about what needs to be included in your beauty salon business plan.

Why do salons fail?

There isn’t one singular reason salons fail. 70% of non-franchise salons, spas and barber shops are owner- operated.

Salons fail at different stages in a salons’ life cycle. Salons that fail in the first two years are typically owned by salon professionals that do not have a grasp on what it is like to run a business, before it’s too late.

A well-thought-out business plan lends itself to understanding what salon ownership entails and how to prepare for leaner hair care service income.

Established salons fail when owners grow tired of running the day to day operations. Walk outs, disasters, theft and low income can make owners want to throw in the towel.

Prevent salon failure by hiring a salon consultant, browse our comprehensive list to find your ideal salon coach.

Owning a salon without being a hair stylist statistics

If you are not a hair stylist and are considering opening a salon, it is crucial to understand salon industry statistics before committing to a lease. Frequently, non-salon industry owners can become successful proprietors due to their strong emphasis on enhancing the client’s experience.

Non-hair stylist salon owners can achieve higher earnings when they effectively manage inventory and maintain a focus on expanding the salon within target markets. Although hairstylists and cosmetologists are often highly creative individuals, they might lack the necessary business training and money management skills required for operating a successful salon.

For non-hair stylist salon owners, the most significant opportunities lie in salon franchises and salon suites. Franchises provide resources for hiring, marketing, and overall business management.

Salon suites, on the other hand, offer ease of management and are frequently owned by investors or salon enthusiasts who are not themselves hair stylists. When working with the salon industry, it is advised to gain as much knowledge on the inner workings of our industry, before becoming an owner.

Salonspa Connection offers free resources such as a list of salon consultants, coaches and mentors, buy a salon page, blog and salon recruitment.