Hair Stylists Insurance | Salon Owner Insurance | Beauty Industry Insurance Companies

Paying too much for hair stylists insurance or not getting the coverage you need as salon owners can be detrimental to a beauty business. Before buying beauty insurance, read our guide.

Despite big promises from large companies, once you know the options it will significantly reduce overpaying and not getting the right policy. We walk you through why you need insurance, what can happen if you don’t have the right coverage and pricing for the best hairdresser insurance.

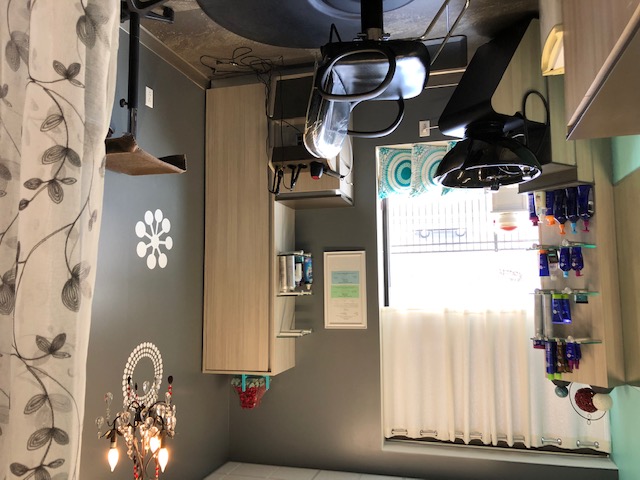

Independent stylists and salon owners need proper coverage. Beauty services are fun and make people feel good, BUT things happen in the salon!

Rather than guess which company is on your side, we recommend GILD. Insure your professional services and explore coverage options with GILD to get the best rates and choose the right insurance for your business, today.

Why Salon Owners Need Salon Business Insurance

If you are a solo salon suite renter or you have stylists working in your salon, you need protection. Booth renters are also considered to be a small business owner. A few examples of why you need insurance: Lost wages, fires, stolen property, customer claims, slip and fall and missteps in doing client’s hair.

Doing business means you open yourself up to lawsuits. In this crazy world, accidents happen and people can be just downright crazy. Not having protection means you open yourself up to viscous claims and lost wages- it’s not worth the risk!

If you are self employed, chat with GILD today. They are a company that CARES about the salon industry.

Client Lawsuit

Salons and hairdressers get sued. Despite doing a fabulous job with hair extensions or the best dye job in the city, things can go wrong. Eventually a client’s hair won’t turn out to their satisfaction.

Hair salons get sued over client dissatisfaction, customer injuries, accidents and property damage. If the client’s visit to your salon results in medical bills, you can guarantee there is a lawyer who thinks they have viable lawsuits.

Skipping out on the right coverages is not the way to save money. Protect your small business and equipment, today with the insurance agency that works with our industry. Contact GILD today for your specific coverages needs!

Property Damage

Insuring your salon means having a great general liability policy. Generally, clients bring valuable purses, clothing, cars, mobile phones and jewelry into the beauty salon.

As a hair stylists we do all we can to avoid damaging a client’s personal property. Eventually stuff happens- earrings get lost, color gets on clothes and we drop color onto customers belongings.

Even the most careful stylist makes mistakes. Get the right general liability insurance coverage to protect your salon business from property damage claims. Contact GILD for a policy that preserves your beauty services and business.

Injuries and damage involving your business vehicles

Mobile salons or salons on wheels need commercial auto insurance coverage. Henceforth, if hair stylist employees or booth renters are using company vehicles, protect your business with the company that understands salons.

Property insurance does not typically include vehicle coverage. Understanding the policies needed for your specific salon can be difficult. Get the coverage you need with a free quote and start saving money with GILD, today!

Get the help you need for your career and business in the salon industry. Click here to visit Salonspa Connection’s Website.

General Liability Insurance | Salon Insurance Companies

If you are a booth rental stylist or salon, you need general liability insurance. This protects you from bodily injury, medical costs and work related injuries. Overall, doing hair is the best job in the world BUT can come with problems, make sure you are covered against lawsuits- contact GILD today for a free audit!

You never know what is going to happen. Ensure customers can’t take your business down, contact GILD today for a free financial protection insurance quote!

Workplace injuries

Cuts, burns, allergic reactions and falls are the most common workplace injuries in hair salons. Work related injuries cost salon owners millions of dollars a year when they are not properly insured.

Furthermore, liability insurance is the smartest policy to have in a salon. Protection cost pales in comparison to the amount of lost business income and legal fees associated with lawsuits to cover medical expenses.

Professional liability is a must have for a salon owner and independent beauty professionals. Ensure third party accidental bodily injury doesn’t close your business. Contact GILD to get the best rates and coverage for your beauty salon, today!

Stolen Customer Information

Do you have salon customer’s information in your salon booking software? What about an in house software program? If you answered YES, you need to be covered.

Since you retain a salon client’s information you are at risk for identity theft and stolen customer information. If you retain credit card and personal client data, you may need cyber liability insurance.

If your hair salon has a non-compete clause in your employment agreement, your salon may file lawsuits against stylists who leave and take clients with them. Work with people who understand the needs of salon owners. Contact GILD today for a free quote!

Learn more about salon non-compete agreements in our blog.

Business Insurance Coverages for Salons

Salon businesses need more than just business, they need a great insurance company to work with. General liability insurance, business property and details for additional insured should be handled by experts who know the hair salon industry.

Get answers to the most common questions surrounding general liability coverage and the best hair stylist insurance policy. Contact GILD, even if you are already working with an insurance company to make sure you have the coverage you need.

Customizable Insurance | Salon Insurance Cost

Every salon has different insurance needs. In fact, hair stylist insurance cost depends on services you offer, location, past claims and the size of your business.

Hairdresser insurance looks altogether different than the type of protection a large salon would need. If you own your property or rent salon space, you will need to have property insurance.

Offerings and services vary, not all salons offer a dye job, some serve only children or male clients. Consequently, your beauty salon may be paying too much for coverages you don’t need. Worse yet, your business may not be covered for product liability or equipment.

GILD salon industry customers get covered claims and third party claims covered! Contact GILD today to ensure your small business is properly protected.

Insurance for hair stylist

If you rent a booth, a salon chair or occupy a salon suite, you need to protect your business. Firstly, hair stylist insurance is not only affordable, it’s a necessary business expense if you are self employed.

Professional liability insurance will protect you against bodily injury claims from customers. Therefore, providing hair services means you are at risk for client lawsuits.

Get the best hair stylist insurance policy and coverage with GILD who specializes in hair salon business insurance.

What defines an independent stylist?

Being an independent stylist means you are self employed. Specifically, clients pay you, not the salon for services. Independent stylists work in salon studio suites, open concept salons as booth renters, in home salons and in mobile salons on wheels.

Business insurance protects against equipment loss, theft and acts of god that can happen in beauty salons. Surprisingly, even the most beloved client can make claims if things go awry in your small business. Salonspa Connection trusts GILD for hair salon insurance protection, contact them today for a free quote!

What is hair insurance?

Purchasing insurance means you are covered for accidents and claims made by customers who receive services. Otherwise, additional coverages can include business insurance, work related injuries, property damage and bodily injury.

Need help understanding which beauty services insurance policy you should have? Contact GILD for a free quote for your hair salon, today!

What does professional liability cover?

Professional liability insurance covers a host of salon problems that can occur. This generally means: Hair loss from extensions, scalp burns, excessive heat damage and disputed payment information claims. Contact GILD today for the best coverages!

Personal Injury

Bodily injury happens when chemicals and heat meet business. If you have been injured or clients are at risk, avoid lawsuits from cutting hair with GILD’s additional coverages, today!

Professional mistakes

Beauty salon work comes with mistakes, there’s certainly no way to get around it! Especially hiring new salon professionals or learning new services puts us at higher risk for mistakes. Protect your business income with GILD’s best fit hairdresser insurance.

Salon Insurance Coverage Quotes

Explicitly, if you aren’t working with GILD, you are probably paying too much and don’t have the best liability coverage. Get a free quote and understand hair stylist insurance costs you should and should not be paying for!

Which type of insurance will help protect the salon if a client sues claiming they were injured from the use of a salon product?

Allergies, burns and product injury claims are protected with general liability insurance. Thus, protecting your salon against a client lawsuit with hair salon specialty group- GILD is a must!

What does professional liability insurance generally cover and not cover?

Professional liability insurance protects against claims of injury, illness and damages from hair salon services.

Considering adding additional coverages

Beauty services and products offered outside of a “typical” hair salon may require additional coverages. Finally, your hair salon could benefit from additional insured coverages with GILD.