Opening a salon, spa or barbershop? Thinking through salon financing options and educating yourself on the best lender or method to get enough money in your pocket, is an important piece of a great business plan.

Thank you for reading this post, don't forget to subscribe!

While starting a salon from the ground up is an exciting idea- overlooking the fact that buying a beauty business is a wise investment should always be the first consideration for smart entrepreneurs.

My name is Susan Wos, in our work with salon sellers and people who buy salons, the issue of the funds you need to help your salon successfully launch is always a hot topic. There are a number of ways to fund a small business, here are the most common methods for a salon startup:

Whether you plan on buying an existing salon industry business or opening a salon from scratch, having enough capital to last through the building phase of your business is key to success. In this blog, I will cover the benefits and drawbacks to the types of salon financing available and touch on equipment financing options.

The amount you need to open a salon depends on several factors. If you’re just starting a business, you need a solid business plan to understand the costs involved in buildout, marketing, recruiting, purchasing equipment and supplies. Having enough cash flow in the first few months is an important aspect to factor into startup costs.

The bigger the space, the more money you will need to help you grow your business. There are empty salons for sale as well as thriving salon businesses for sale that will help to expand your business faster than starting from ground zero.

Exploring all of your options, walking through potential spaces to rent and fully understanding your local market will pave the path to opening your dream salon.

First, a good credit history, (640 credit score or above), and background or how long you’ve been in business as it relates to how well you can successfully operate a salon. These are two important factors to finance salon businesses. Lenders look for your ability to pay back a loan, collateral, available funds and a well thought out business plan.

If salon ownership is what you have been dreaming of but you don’t the means right now, that’s ok! If you don’t have money or a client base to get you off and running, here are ideas on how to get yourself to a place of being ready to own:

Open a Salon suite. A microsalon is a great way to find out what your capacity is to own. Often, salon suites are where owners start out an them move to a bigger space once they have an idea of what it’s like to be a salon owner.

Immersing yourself in the industry as much as possible will help to make your path to ownership a reality!

What you need to buy when starting a salon varies- employee based businesses require more equipment and supplies. Booth rental businesses are more simple in the fact that you won’t need to supply things like color or perm rods.

First decide what you want to supply your team, make a list of everything they will need for the best chance at success. Spend some time in salons to understand where you can cut costs and what are essentials for your business model.

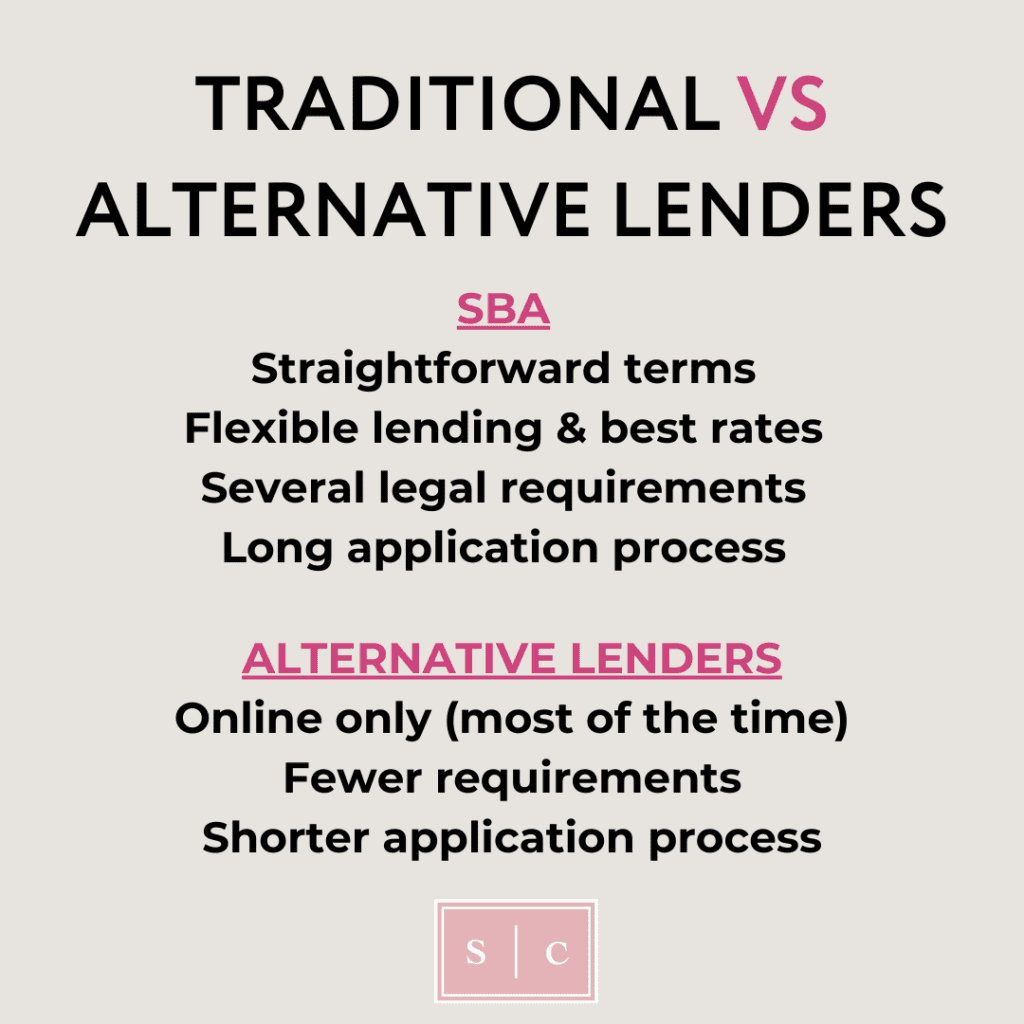

The most common way to get financed to open a salon is through the Small Business Administration or the SBA. Generally speaking, you can work with Salonspa Connection or go through the application process on the SBA’s website and get matched with a local lender.

An SBA or bank loan is much like the loan for your car or your house, but there are a few key differences in order to qualify for a traditional loan. The SBA 7a loan will get you everything you need with friendly payment options. Vist the SBA loan website to determine if a 7a loan, 504 loan or a Microloan is best for your business financing needs.

Loans from an alternative, online lender work like business loans from traditional banks. Alternative lenders often have more generous qualification requirements and tend to fund faster. Be ready to pay a higher interest rate and adhere to shorter repayment periods.

Be careful with predatory lenders like Snap Finance! Do your research, first, on alternatives for financing loans. Check out Bankrate.com for more popular alternative funding sources for loans.

Lenders generally want to see a minimum credit score of 610 to 640 to qualify for a loan.

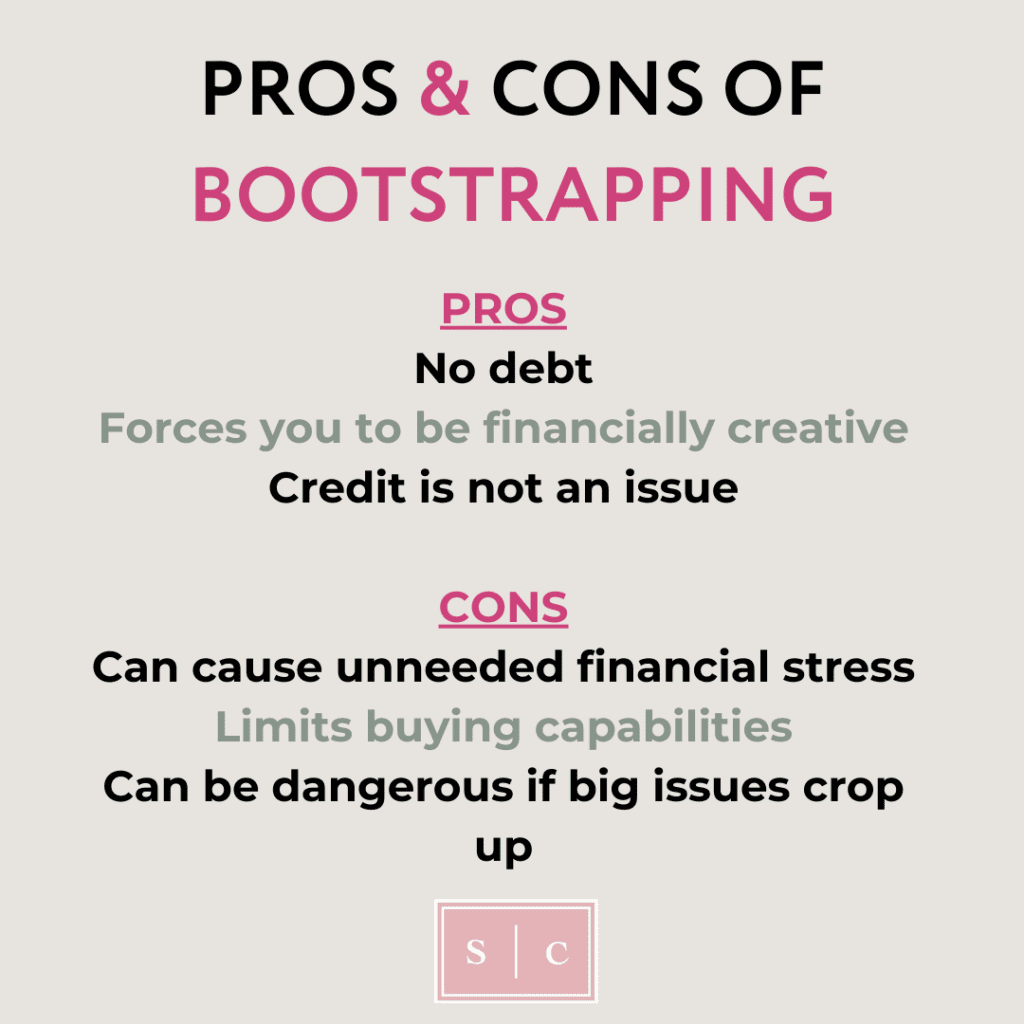

The second most common way to get enough money to buy equipment for your salon and complete construction is by self-funding. While this is great for those with poor personal credit and people who don’t like debt, this can be a difficult path for a source of capital.

I speak from direct experience on bootstrapping- this is a difficult path to choose BUT not owing anyone, anything, feels good once the annual revenue surpasses the amount you invested.

Bootstrapping is opening and growing a business without external help or funding. By using personal savings or existing resources instead of relying on investors or loans, you effectively won’t owe anyone a dime, but this can cause a lot of unneeded distress for a new owner.

The more time in business and industry experience you have, the better when deciding if bootstrapping is the best path to take.

Outside of taking out a second mortgage on your home, a business line of credit may be the best beauty salon loans for you. This works a bit like a credit card- you get approved for a certain amount and you pay interest on the amount borrowed.

This is unlike a traditional loan where you are given a lump sum, a line of credit allows more flexibility to take money out on an as-needed basis. Often. a monthly repayment term is established allowing you to budget in the amount you need to repay the line of credit.

If you have access to some capital from bootstrapping, friends or family, getting a line of credit may be the best route to take. The type of financing you choose affects your business for many years to come.

If new barber furniture or salon chairs is all you need, a salon equipment line of credit or loan may be ideal. We gathered a few equipment financing loan and lines of credit in case all you need is equipment. Here are some options for equipment only loan or line of credit:

It can take up to three business days or longer to get approved with salon furniture lenders, shipping can take several weeks. Plan ahead and apply at least a month before you will need your new equipment!

A personal or business credit card may be enough to get you equipment and items you need to purchase. The issue with financing your business through credit cards is it is more difficult to get enough capital to pay the rent and other things you will need to open the business.

Funding through a personal or business credit card could be your only option if your personal credit score isn’t where it needs to be to get traditional financing. Much like with any spending on a credit card, the interest rate is typically much higher than what a loan could be.

Before choosing this route, look at the amount by the factor rate in which a full repayment would be vs. an SBA type of loan. The quick-fix credit card option is almost always not a good way to fund a business.

Getting a grant is a fantastic way to fund a salon! The problem with grants are they are very difficult to get. Grant organizations review thousands of applications per month…

Grants are typically for oppressed members of society or for those who have experience true tragedy such as a natural disaster that inhibited your ability to be a successful business owner. Even just applying for grants is a full time job!

If you are dead set on getting a grant, do your research to find organizations that reward people in your demographic or area of specialization. Plan on one year or more of applying to grants and researching to find grants that you qualify for.

If you are a hype girl, (or guy), crowdfunding may work to get money for a business. Resources like GoFundMe or Kiva are crowdfunding resources that can potentially help you raise capital.

This involves a fair amount of work and you will need to read up on the SEC regulations and uncover the platforms that won’t payout unless you meet your minimum fundraising goal.

Crowdfunding for a business venture is common, however, not as easy as it sounds. To be a successful crowd-founder you will need to promote the opportunity- A LOT and accept the amount you raise.

Receiving funding from friends, family or an investor lender may be a good options for you. If you are well respected, well connected and have a proven track record of success, getting money from close sources may be the best route to take.

Investors are often people you know- unless you are opening a high-dollar franchise or multiple businesses, it is unlikely you will need capital from angel investors or firms. Most of the time, investments come from people you know and trust.

Get a great business plan and start feeling people out with your ideas. ASK trusted friends and family about what THEY would do to get funding- this may spark a conversation about how they can help or they may have someone in mind that you can talk to.

Whether you’re just starting out or in need of additional capital to grow, there are a host of different financing options. If you have good credit and proof of industry knowledge & success you’ll have the option to get financing from lenders.

If you are well respected & connected, getting money from people you know may be the best path to take. I hope you have found this salon funding roundup helpful and will come back to Salonspa Connection for other business needs!

Yours in service,